The UKMOD platform, developed by our Centre for Microsimulation and Policy Analysis, has been used by the international thinktank, The Tony Blair Institute for Global Policy, to assess the ‘overnight’ impact of the impending National Insurance increases and rising energy prices across all of British society. UKMOD is a microsimulation tool which allows for tax and benefit policy changes to be tested on real data on incomes and living standards.

With over 90 users across academia, government, the devolved assemblies, and the third sector, UKMOD is a tax-benefit microsimulation model based on the UK component of EUROMOD, enhanced and extended as part of a 3-year project funded by the Nuffield Foundation.

The Institute has produced three reports looking at the impact and assessing policy responses.

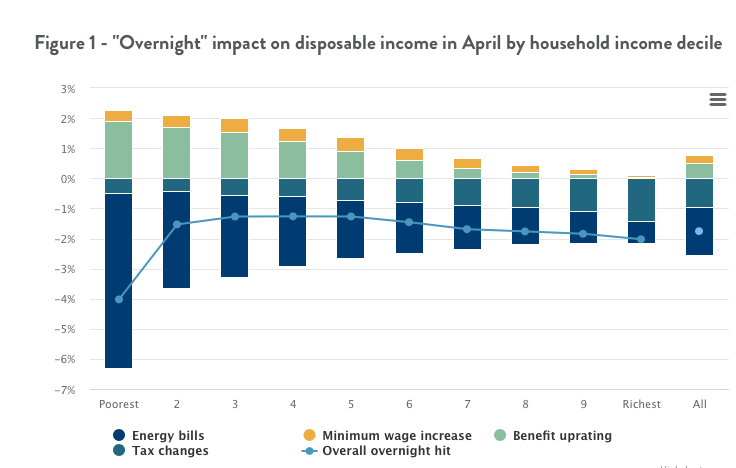

The Institute states: ‘Household incomes are facing a shock in April. Since the summer, an unprecedented spike in energy costs combined with a surge in wider inflation has caused the outlook for living standards to deteriorate dramatically, especially for lower-income families for whom energy costs make up a significant portion of weekly spending. Wholesale gas prices remain around three times the level they were last summer. Consumers have to date been largely insulated from these effects by the price cap, which has meant that suppliers have been unable to pass the full impact of cost rises on to consumers. So far, instead, a large number of energy suppliers have gone bust.

But things will come to a head in April, when the price cap is set to jump. Just how high it will go will be decided on 7 February, but Cornwall Insight anticipates the energy bill for a typical household increasing from around £1,300 per year today to around £1,900 from April, with a further rise to over £2,200 expected in the autumn.

Unfortunately, this comes right at the moment when tax rises begin to bite. The chancellor’s £14 billion Health and Social Care Levy raises national insurance contributions (NICs) by 1.25 per cent for employees and a further 1.25 per cent for employers in April. The income tax personal allowance and higher rate threshold will be frozen. And local authorities are expected to raise council tax by up to 3 per cent in the spring, too.

It’s not all bad news for households in April. The National Living Wage will rise by 6.6 per cent, a significant increase for those affected. Cash benefits and other tax thresholds too will be uprated at the start of the new tax year, although the September inflation rate on which those increases will be based was, at 3.1 per cent, considerably lower than the current rate of 5.1 per cent. This means that although benefits will rise in April, they’ll still be about 2 per cent lower in real terms this year than they were last year.

This multiplicity of shocks will affect different households in a variety of ways. Overall we’re set to see a significant “overnight” hit to households’ disposable income in April, which is expected to fall by £56 a month on average. This change represents 1 to 2 per cent of net income for most income groups, but substantially more for the poorest.’

Read more on the Tony Blair Institute for Global Change reports Living Standards Crunch – Who’s Affected and How and Policy Options To Ease The Cost Of Living Crisis and Poorer Households Face The Worst Living Standards Shock