A new report published by NHS Scotland uses ISER’s tax-benefit microsimulation model, EUROMOD to predict the impact of possible policy changes on a range of health inequalities.

Income-based policies in Scotland: how would they affect health and health inequalities? explores how the tax and benefit rules may affect health and health inequalities in Scotland through one of their main determinants: net household income.

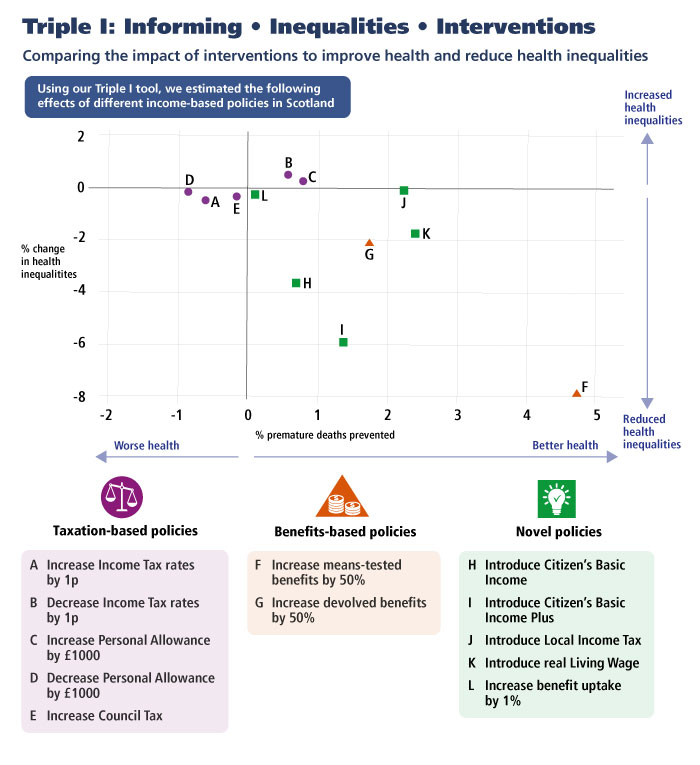

Using EUROMOD – the tax-benefit microsimulation model developed at ISER at the University of Essex – and the Scottish subsample of the Family Resource Survey (FRS), the report studies how household net income would react to the introduction of a range of potential changes in the tax-benefit rules. They then feed this information into the “Triple I – Informing Interventions to reduce Inequalities” model – the Scottish Public Health Observatory’s (ScotPHO) health inequalities scenario modelling – to analyse the potential health impact of such policies.

Assuming a causal relationship between income and health, the research suggests that the most effective income-based policies for reducing health inequalities are likely to be those that disproportionately increase incomes for those with the lowest incomes. Income-based policies such as increasing (non-devolved) means-tested benefits, devolved benefits, introducing a Citizen’s Basic Income (CBI) scheme partly financed by higher income tax rates or introducing the `real’ Living Wage are shown to have the potential for improving health and narrow health inequalities in Scotland.

Whilst this is a first attempt of combining simulations of tax-benefit policies produced by EUROMOD with those of health indicators produced by the Triple I model, this research confirms the crucial role of tax-benefit models, such as EUROMOD, for informing the policy debate on potential effects of policy choices.

Take-home messages from the report

-

Health inequalities in Scotland are stark and represent thousands of unnecessary

premature deaths (death under 75 years) every year. -

Income is a key determinant of health. Policies that affect income have the

potential to influence healthy life expectancy and health inequalities in Scotland. -

Modelling is an important source of evidence for prompting discussion and

guiding decision-making about potential policies and interventions. -

The Triple I (Informing Interventions to reduce health Inequalities) modelling tool

has been designed to estimate the potential health impact of individual policies

that affect household income, without actually implementing them. The basis of

the Triple I tool is that health improves as household income increases. -

Our modelling suggests that selected income-based policies could improve health

and narrow health inequalities in Scotland.

These policies include:

– increasing means-tested benefits by 50%

– introducing illustrative Citizen’s Basic Income (CBI) schemes that

incorporate increases to Income Tax rates

– increasing devolved benefits by 50%

– introducing the ‘real’ Living Wage.

-

The most effective income-based policies for reducing health inequalities are

likely to be those that disproportionately increase incomes for those with the

lowest incomes. -

Of the policies modelled, the introduction of a CBI with additional payments

for disabled individuals would be most cost-effective for both reducing premature

mortality and reducing inequalities in premature mortality. -

The effects of a wide range of income-based policies on health and health

inequalities can be modelled for different geographies and different health

outcomes using our interactive policy modelling tool. -

Although modelling is subject to various assumptions and uncertainties,

our findings highlight the importance of applying an inequalities lens to

income-based policy options.

Download the briefing paper here

Find out more here about our open event on new research on Basic Income on Monday 5 November