Over the last decade, increasing attention has been given to the idea of going beyond monetary measures to assess social progress. New EUROMOD research by Dr H. Xavier Jara with Professor Erik Schokkaert from the University of Leuven, shows the importance of taking into consideration a broader range of wellbeing indicators to assess the potential effect of policy reforms.

Measuring individual wellbeing

From a policy perspective, the use of income as a measure of individual wellbeing has been predominant. This is particularly the case for the evaluation of taxbenefit reforms, which focus mainly on the effects on the income distribution. In recent years, however, there has been increasing agreement about the importance of considering other life dimensions in the evaluation of wellbeing in society.

Subjective wellbeing measures, such as happiness and life satisfaction, have recently become popular. Numerous studies have shown that, in addition to income, life dimensions such as health, employment, housing and environmental quality are important determinants of subjective wellbeing; and increasing effort has been put by national statistics offices to collect subjective wellbeing measures in large representative surveys. The use of subjective life satisfaction for policy evaluation has, however, been called into question because it is not only determined by objective outcomes of life and the importance individuals attach to life dimensions, but also by aspirations and expectations. As pointed out by Nobel Prize winner Amartya Sen, “A person who is ill-fed, undernourished, unsheltered and ill can still be high up in the scale of happiness or desire-fulfilment if he or she has learned to have ‘realistic’ desires and to take pleasure in small mercies”.

Different approaches have been considered to define wellbeing measures which go beyond income but also beyond subjective wellbeing. An alternative measure is the so called “equivalent income”, which determines the level of income that, combined with the best values of non-income life dimensions (e.g. perfect health), would keep a person in a situation she considers equally good as her initial situation. Equivalent income encompasses multiple life dimensions and is not affected by aspirations and expectations, ensuring respect for the relative importance individuals attach to different life dimensions.

Which policies work

Our study uses EUROMOD, the EU tax-benefit microsimulation model and data from EU-SILC 2013 for Sweden, which contains information about life satisfaction and satisfaction with specific life domains, as well as information about feelings and emotions. Our analysis consists in assessing whether the effect of hypothetical policy reforms differ depending on the measure of wellbeing considered in the evaluation: income, life satisfaction or equivalent income.

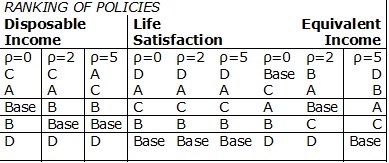

Four alternative and budget neutral tax-benefit reforms are simulated: (A) an additional payment for recipients of social assistance; (B) an increase in the basic amount of child benefit; (C) an additional payment of housing allowance for pensioners; and (D) an improvement in the quality of low-quality housing. Our simulation results confirm that the choice of wellbeing measure is important for comparing the impact of different policies (see table below).

Looking beyond income provides a better picture of individual wellbeing and makes it possible to analyse the effects of non-monetary policy reforms such as improvements to housing quality for example and to compare the welfare effects of such reforms with those of tax-benefit policies. Additionally, interactions between different life dimensions should be considered. For instance, the effect of income changes on health following a policy reform.

Our study is particularly relevant given the increased effort by national governments and international organisations to collect data on monetary and nonmonetary life dimensions and subjective life satisfaction.

Microsimulation models should exploit the availability of richer data to analyse the role of the welfare state on individual and social welfare taking into account a wide range of life dimensions.