A new report provides a comparative analysis of the distributional effects on household incomes of tax-benefit policy changes between 2015 and 2016 for each EU member state.

The report – Effects of tax-benefit policy changes across the income distributions of the EU-28 countries: 2015-2016 – follows the publication last year of a similar analysis covering policy changes between 2013 and 2014 and 2014 and 2015 which has now been updated to incorporate revisions to inflation data, the availability of more recent information on incomes and model improvements.

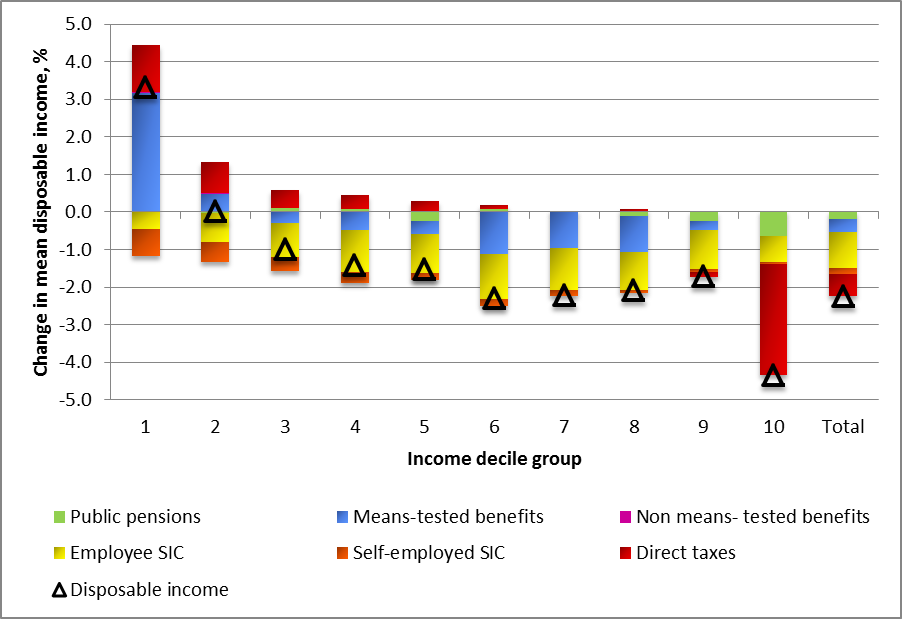

As last year, the report shows the policy effects (first-order) measured in real terms by policy type for each income decile group. Policy effects are described and accounted for on a country-by-country basis – with a short commentary explaining the effects of reforms and the extent of indexation, relative to inflation.

For 2015-2016, the policy effects across the EU-28 ranged from an overall decrease of 2.2% of household income in Greece to an increase of 5.3% of household income in Poland – this is the largest range in effect of the three periods analysed in this series. The image illustrates the policy effects in Greece, where losses in income stemmed mainly from increases to both social insurance contributions and the solidarity contribution, plus the introduction of an upper limit to public pensions – these changes impacting most heavily on the highest earners.

In line with the two previous periods, the effects of 2015-2016 policy changes were progressive in most countries. But for further detail – including a country-by-country view across all three periods now covered by this analysis – download the report.

Also published this month is the EUROMOD working paper Baseline results from the EU-28 EUROMOD (2011-2016). This report sets out the baseline results from the latest G4.0+ release, presenting indicators for income inequality and poverty risk using EUROMOD and examining differences between these estimates and those obtained directly from EU-SILC data. The report also provides estimates of marginal effective tax rates (METR) for all countries.

The latest set of EUROMOD statistics on the distribution and decomposition of disposable income – also updated for the G4.0+ release – were made available in March.